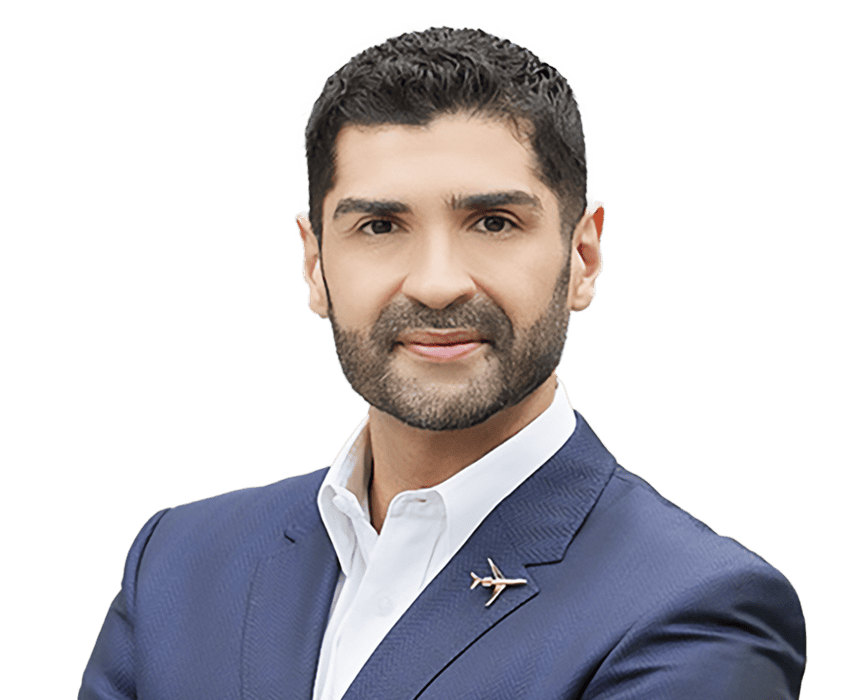

Author/contributor

Paul Jebely

Partner

Paul Jebely, who has held a Chambers & Partners Global Band 1 ranking in Private Aircraft since that category’s creation in 2015, recently offered his perspective on private aviation in the Chambers High Net Worth Guide. Paul – who is described in the Chambers client feedback as “the Top Gun for ultra-high net worth aircraft owners” and “the billionaire whisperer” – maintains a global practice covering the purchase, sale, finance, lease, ownership, and operation of private aircraft.

He has advised clients whose combined private wealth has exceeded USD 1 trillion and concluded deals valued at nearly USD 24 billion. You will find Paul’s presence in conventional transactions and novel matters shaping the industry. He founded The Hague Court of Arbitration for Aviation and The Financial Times also recently described him as a “top private jet lawyer,”

Paul begins by observing that “[I]n many ways, private aviation is a microcosm of modern capitalism: a complex, dynamic ecosystem that not only reflects, but also capitalises on, the ebbs and flows of economic cycles, global politics and evolving societal values.” His experience reveals how many of his clients benefit from private aviation, writing, “[a]s the global economy and geopolitics go through cycles of boom, bust and bizarre, those able to ascend above it … can seize a notable edge.”

From an environmental perspective, investment in sustainable fuels, carbon offset programs, and innovative propulsion studies increasingly shape the sector. This move stems from public attention on high net worth individuals, coupled with a broader push for responsible development. Such societal and political pressure influence manufacturers, operators and owners worldwide and have led some owners to lean toward shared models. Others remain committed to sole ownership. Paul points out how this results in “a tiered tableau of growth, where innovation converges with regulatory realism, that challenges both old paradigms and emerging opportunities alike.”

Paul remarks that fractional usage gains ground in places with strong growth, but conventional approaches continue where caution prevails. He observes an influx of newcomers to the industry who advertise themselves as aviation consultants without proven credentials or, in many cases, adequate competence. That raises concerns for owners looking to protect significant outlays. He points to the need for thoughtful diligence backed by credible advisory. Otherwise, trust in the overall marketplace may erode.

Financing stands out as another shifting area. Some lenders slowed their return to aircraft lending after the downturn. As Paul writes, “[m]any astute aircraft owners have leveraged their aircraft – whether previously unencumbered or newly acquired – to bolster liquidity and seize emerging opportunities.” Paul notes that traditional loans still hold the largest share, but leasing grows incrementally.

Paul observes that “[i]t is no secret that the private aviation marketplace functions as an ecosystem of intermediaries.” He highlights that private aircraft transactions rarely fit a perfect market model. Buyers and sellers operate in an environment with limited transparency and data. That explains his emphasis on what Paul calls “a zero trust architecture” – each phase, from escrow to final signature, guards against unwelcome surprises. Not surprisingly, for someone who founded the International Aviation Arbitration Court, he sees legal disputes best managed through arbitration or mediation, preserving discretion and preventing public disputes.

Read the full Chambers article here to learn more, or reach out to Paul to learn how our aviation practice can help protect and advance your interests in private aviation.